Car Dealers Must Monitor the Social Web to Remain Competitive

After perusing the data contained in a recent customer survey report from by J.D. Power and Associates and NetBase, my conclusion was that younger car buyers (under age 55) are overwhelmingly telling car dealers:

“Respond when you’re being spoken about…but, only when I want you to!"

The “Social Listening and Big Brother eBook” by NetBase and J.D. Power and Associates that I am referencing is available for download at: info.netbase.com/SocialListeningeBook.html.

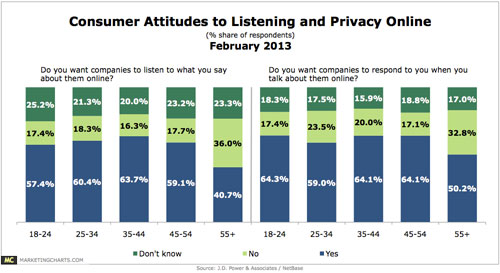

The data point which grabbed my attention, and I consider to be of most significance to car dealers and automotive marketers is that 64 percent of 18-24 year old consumers want companies, including car dealerships and manufacturers to respond to them when they mention the company's name or brands online.

Staying remarkably similar to “Millennial” car buyers, even the older age groups mirror that same, seemingly petulant "we speak, you respond" sentiment. This showcases an increasing need for dealerships to monitor the social web for mentions of their name, or references to the makes and models they sell. Consider that social media has primarily a locally focused mind-set, so do you really want the car companies taking control of relationships with your local customers?

As the age demographics segmented by the survey get older, you cannot help but notice that just half of the 55+ group agree with these same sentiments. It is important and intriguing to note that while the survey results suggest consumers want car dealers and OEM manufacturers to respond to discussions about their products and services online (UGC based social media), separate results from the survey paint a more confusing picture.

An example of this confusion and possibly a double standard when it comes to online monitoring is that roughly 60 percent of respondents aged 18-54 want companies to listen to what they say about them online. T

his drops to 40 percent for the 55+ group. While at the same time, about half of the survey's respondents think that consumers should be able to talk about car dealers online without the dealer listening in. The 55+ age group further emphasizes this desire for privacy, with 59 percent saying they do not want companies such as car dealerships seeing what they post about them online.

But wait…There's more (confusion) in these survey results!

So, while well over half, and as many as two thirds of consumers in all age brackets say they want car dealers to respond when they’re being discussed online, the same survey reports that more than 60 percent also believe that companies such as car dealerships should onlyrespond to online comments made directly to them, such as on the dealership’s Facebook page, YouTube Channel, referencing the store’s Twitter handle or similar.

I recommend that every dealer principal, general manager and marketing director download the PDF file of the report and take a look. In my opinion, what we are seeing is the variance based on where and what types of social media these comments are being made that reference a dealership by name, or the makes and models that dealer sells.

The report’s authors seem to be having fun when they write that the takeaway for automotive marketers and others who handle social media strategy is that they should be “telepathic.” For those of us who have sold cars for a living, we know that a little bit of mind reading is a job requirement! Perhaps "empathetic" would be a better choice of words and not so much in jest.

In addition to using good judgment and lots of empathy when monitoring and responding to online references to your dealership, my advice to automotive marketing professionals is as follows:

- Automotive social marketers should go beyond listening — look up the customer in your CRM or lead management tool. Do some due diligence before responding.

- Go beyond simply trying to understand what the customer is saying, and focus on what the customer was feeling that motivated the post being made.

- Study the beginning of the thread and follow the comments all the way to where the dealership was mentioned. Always put the comment into the conversation’s context.

- When you do decide to engage a customer online, focus on delivering mutual value. Nobody expects a car dealer to be Santa Clause, ask for a positive follow up post.

- For many of us who are used to outbound communication, optimizing online customer engagement is about using our “listening skills” as a relationship-building tool

Other Findings with the Report:

- Less than three-quarters of consumers (ranging from 62 percent of 18-24-year olds to 72 percent of 45-54-year-olds) know that dealership employees might be listening to what they’re saying online.

- Roughly 40 percent of consumers aged 18-54 feel that dealership employees monitoring online conversations are intrusive. That number rises to 54 percent among 55 and over automotive consumers.

- Customer opinion regarding whether dealerships should monitor online conversations to improve products and services vary significantly among age groups. This ranges from 40 percent of the 18-24 set believing dealers should be listening, 57 percent for the 45-54 group, and 37 percent for the 55+ set.

- More respondents expect a car dealership to respond if they make a negative remark online that mentions the dealership by name, than if they make a positive remark about the dealership.

- About the data: J.D. Power and Associates, in association with NetBase, conducted a survey in December 2012 of 1,062 U.S. consumers ages 18–55+.

- Data source: www.marketingcharts.com/wp/interactive/millennials-to-brands-respond-when-youre-being-spoken-about-26947

- Download the Social Listening and Big Brother eBook by NetBase and J.D. Power and Associates: info.netbase.com/SocialListeningeBook.html

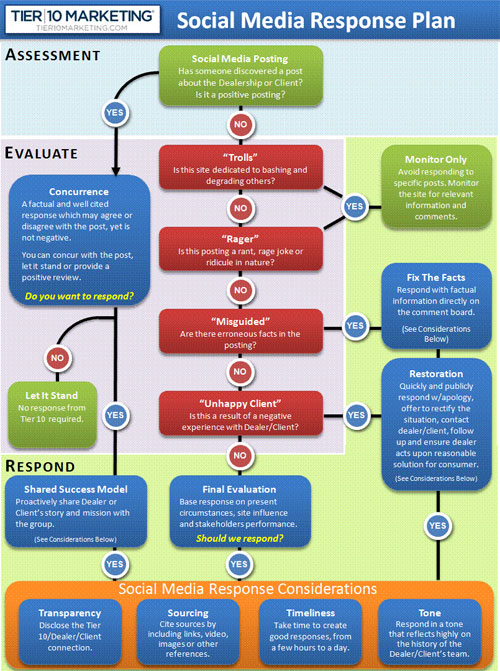

How does a car dealership create a structured response process?

- In regards to the process around a dealership monitoring and then responding to online blogs, comments, posts, and discussions where the dealership is brought up or mentioned, I started developing a process and work flow while launching the ADP Social Media Reputation Management Team in 2009 and 2010. The work flow process shown on the chart is based on the US Military in regards to how the Air Force responds to online comments and blog posts.

- When I left ADP and went to work for Tier10 Marketing at the beginning of 2011, we revised and upgraded the work flow planning for better results and more production efficiency. The chart below reflects the Tier10 Marketing version of what we recommended for dealers:

Ralph Paglia is vice president of digital for Tier 10 Marketing and editor-in-chief of the Automotive Digital Marketing Professional Community (www.automotivedigitalmarketing.com).

authored by

Michael Bowen

Get Curated Insights

Content worth the click

Related Articles