Digital Motors Enables Dealers to Deliver Apple-Like Experience

Retailing has changed radically in the past decade, and it has changed even more radically in the past 12 months. Lockdowns, business restrictions, and fear of disease have conspired to keep the vast majority at home and isolated others far more than they want to be. This has had a profound effect on the way consumers purchase products. Online sellers have seen their sales and market shares skyrocket, while those who rely on in-store foot traffic have seen sales tumble and, in some cases, have been forced to close up shop forever.

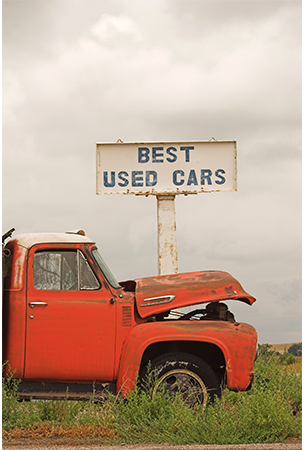

When one looks at various types of retailers, one can make the case that car dealers, in general, have been among the slowest to change the way they do business, even as the world around them has changed. Taking the attitude if-it-ain't-broke-don't-fix-it and safely ensconced behind state franchise laws and licensing regulations, many dealers still operate their businesses in much the same way they did in 1960, 1980, and 2000. Generate foot traffic with advertising, convert a good percentage of those walk-ins into car-buyers, get a piece of the auto financing pie, and sell them some add-ons before they drive off the lot. Retaining a high percentage of those buyers as service customers sweetens the pot.

Retailing Has Changed

That said, it is no secret that today's retailing environment is far different from the environment in 1960 or even in 2000. Consumers have grown to appreciate the convenience and time-savings afforded by the ability to purchase goods online and receive fast delivery conveniently on their doorsteps. Wide choice, product reviews, comparison tools, and price transparency all contribute to consumers' switch to buying on the Internet. Add to that a dread disease and governmental business restrictions and you have a retailing paradigm shift of mammoth proportions.

While many progressive new- and used-car dealers were in the process of investigating and, in some cases instituting online selling processes prior to the onset of the pandemic, once forced business closures hit, that relative trickle of activity became a torrent. Dealers have scrambled to enable themselves to continue to do business in the extremely challenging environment we have seen in the past 12 months, often turning to vendors to help them gain those new and to some extent, very alien capabilities.

What is Digital Motors?

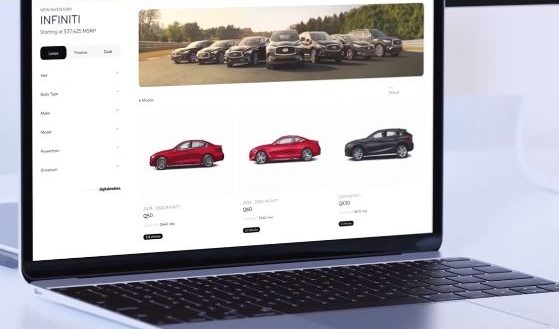

One company that has stepped into that breach is Digital Motors, essentially an online sales platform that gives any retailer of a traditional brand the ability to sell a car "just like Tesla" with an end-to-end online process.

"I guess the sad reality is the only way to buy a new car that way today is if it's a Tesla," Digital Motors CEO Andreas Hinrichs told us. "So Digital Motors set out to change it. And I guess we're in the right place at the right time with the right product."

Southern California-based Digital Motors was founded well before COVID-19. But Hinrichs admits that the rise of the dread disease accelerated the company's development and launch timeline.

"COVID certainly is a significant accelerant to Digital Motors, but it's not the root cause," Hinrichs said. "You know, all the industries outside of automotive have gone to fully transactional over the past 20 years, and auto is the only one that's stuck in lead gen [lead generation]. And that's something we set out to change. And after a year and a half of development, we launched the platform early last year when the shutdown first hit."

The change in the timeline wasn't radical, because Digital Motors had planned a summer 2020 launch. But in light of the shutdown, the startup suddenly had dealers knocking on its Internet doors seeking help.

"So we launched the platform a full three months early," he said. "And, right out of the gate, customers embraced this new process and the platform started selling cars, even at the depths of the first shutdown that happened in the spring."

Because a car transaction is much more complicated than buying a pair of shoes online, developing the platform required dealing with all the complexities and idiosyncrasies of a typical auto purchase transaction that has multiple aspects, including the vehicle itself plus financing, trade-in, and after-sale additions. The typical car sale also involves state and local taxes and fees that often are very substantial.

Beyond that, the auto industry's two-tier distribution model means an online retailing solution must in some ways serve two masters, representing both the vehicle brand and the dealer brand.

Plug and Play

Digital Motors has assembled a process that enables it to create plug-and-play online stores that are a natural extension of the dealer's physical showroom. The customer is able to identify a vehicle of interest from a dealer inventory based on certain search criteria. Then they can structure lease or finance payments, value their trade-in, select finance and insurance products, and get instantly approved by one or multiple lenders subject to the dealer's preference. Buyers can schedule their delivery online as well. So end to end, Hinrichs claims, it takes about 15 minutes in contrast to a process that traditionally takes three to five hours at the dealership.

While that might seem too good to be true, the speed of transaction is facilitated by the fact that in the typical Digital Motors transaction there's no negotiation. In pricing individual vehicles for sale, the dealer is encouraged to put a "solid foot forward." According to Hinrichs, that doesn't mean a race to the bottom or rock-bottom pricing, but a price that the typical shopper would find fair and compelling.

Of course, that is not the end of the transaction. From there, the Digital Motors platform layers on the different marketing campaigns, incentive programs, and lending programs to get the customer to the "transactable" deal. The driving force of the platform is a highly complex, intelligent FinTech engine. It has dealer-adjustable "guardrails," so customers can only put together sensible deals. But at the same time, the dealer is in full control of the economics of the process, just as they are in their physical showroom.

"One of the biggest misconceptions out there is that the more control you give to the customer, this is actually bad for business," Hinrichs said. "What we see on a daily basis is the more control you give to the customer over the transaction, the higher your profit margin is and the happier the customer is at the same time. So the dealer walks away with a better margin, the customer feels fully empowered and is in control of the process. Everybody saves time. And there's virtually zero buyer's remorse afterward."

Apple-Inspired Retail Process

Digital Motors execs say they're attempting to emulate a very familiar retail experience -- Apple. At retail, Apple is completely "channel agnostic." It doesn't matter if the customer puts the entire deal together in the online store or if the customer puts parts of the deal together online, or if everything is done at the Apple retail store. The same philosophy holds true with the plug-and-play experiences Digital Motors creates for its dealer clients.

Digital Motors recognizes that the consumer might not desire a complete end-to-end online transaction with no in-store contact or ability to see, feel, smell and drive the merchandise. It also recognizes that consumers might not want to complete the transaction in one online session, so it allows them to "park" the deal online and then resume on their timeline. The customer can start a deal online, get comfortable with the payment scenario, and then seamlessly finish the transaction at the dealership. Or the customer can start the transaction at the dealership and finish it at home if they like.

"Ultimately, this gives retailers a huge boost in efficiency and customers a lot of empowerment," Hinrichs said. "But Digital Motors is not the consumer-facing brand here. We're the technology platform that enables this experience. We consider our clients' online stores their stores that they own and operate with pricing as they see fit."

Dealer Branding

Digital Motors considers its platform's dealer-branding abilities to be one of its key strengths against other competitors vying for the same dealer-customers. They describe their platform as "hyper-configurable."

"We actually can create something that looks like a custom online store for a particular dealership or dealer group in about 24 hours without writing a single line of code," Hinrichs told us. "And we're able to emulate any franchise branding for any OEM or custom branding for the dealership. So the ultimate result is not only something that resembles the branding of the dealership, lives on the dealership's website domain, but also has a feature set that can be configured to each individual dealer's needs."

Future is a Hybrid

While Hinrichs is absolutely convinced that car shoppers want the option of an online shopping and buying experience, he does not predict that the industry will see a wholesale shift to end-to-end online buying. Instead, he predicts the future of auto retailing will be a hybrid process that lets the customer choose when and what they do online and when and what they do in the showroom.

"At Digital Motors, we do not believe that there is going to be a hard cut over from the traditional offline process to everything all of a sudden occurring online," he said. "What we clearly identified is virtually every single car buyer has an express need to do more online than they traditionally were able to do. Whether this means structuring the entire deal or parts of the deal doesn't really matter. By the time they contact the dealer or visit the dealer physically, they want to have a good understanding of their deal. If if they've played around on the online store beforehand, customers are no longer coming in just kicking tires, taking test drives, and being non-committal. By the time they walk in after getting the transparency on the online store, they're ready to do the deal."

And isn't that what every dealer wants?

authored by

Jack Nerad

Get Curated Insights

Content worth the click

Related Articles