Interview with Experian & Amy Hughes: Customer Acquisition after a Pandemic

The COVID-19 crisis has accelerated preexisting digital retail trends in the auto industry, and focusing on creating a clear digital retailing & customer acquisition strategy is essential for success.

Gone are the days of every car buyer walking through your dealership's lot. Today, car buyers are making decisions faster and spending less time shopping around. A surge in online tools has helped auto dealerships access key data pertaining to the customer buyer journey, giving dealerships the edge to influence a potential car buyer before they make their final decision.

The Dealer Marketing Magazine team met with Amy Hughes, Sr. Director of Dealer Intelligence at Experian, to chat about how auto dealerships can prepare for success and how to leverage data for marketing success.

After the turbulent 2020 the automotive industry has endured, the industry remains fragile. As the pandemic's effects start to dwindle and recovery is in progress, how can auto dealers ensure they're prepared for 2021, no matter what comes?

Within the last 12 years, the automotive industry has weathered two major downturns — first the Great Recession, then COVID-19. While the industry has remained resilient in both cases, we know dealers are looking for ways to continue to navigate the current recovery and better prepare for the future. The answer is data. Staying close to data can help dealers stay on top of rapidly changing trends and respond accordingly.

With more time and data, there is more opportunity for optimization and to outperform any human. With so many kinds of data available these days, what types of data can dealers use to anticipate changes in the dealer market better?

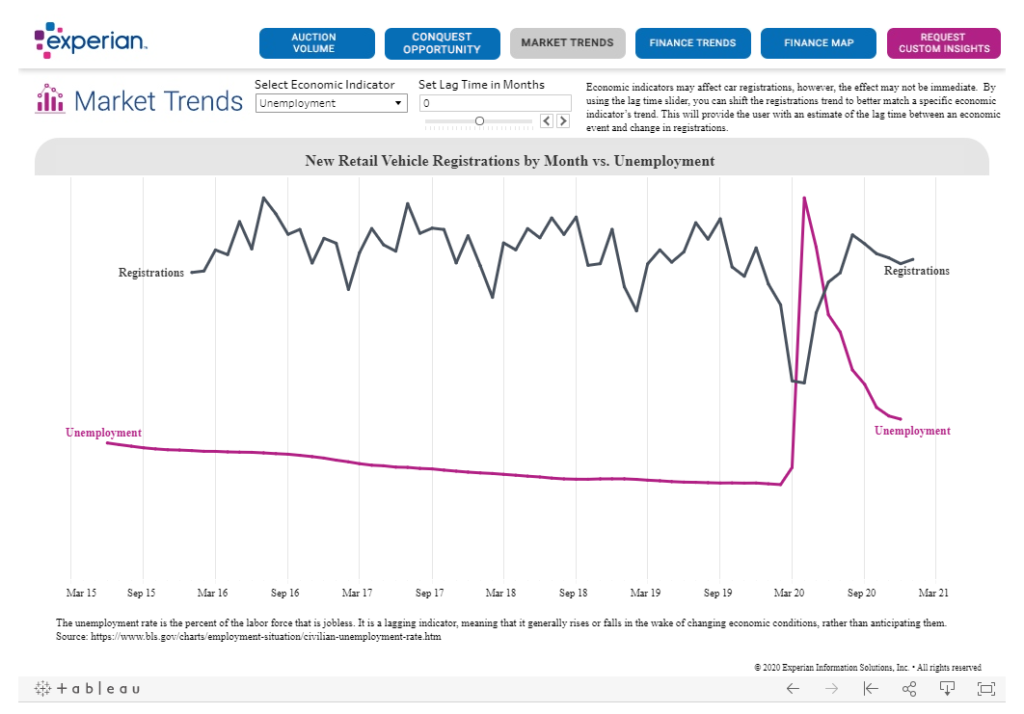

Many auto dealers look at vehicle registration trends, but we've found that those trends can be even more informative when you layer in economic data. This can help dealers identify patterns and be agile in their planning. To that end, we recently introduced Experian Automotive Market Insights, which is a free dashboard that features numerous data points designed to help dealers be more strategic in their decision making as the industry continues to move toward recovery.

For example, a rise in unemployment typically precedes a drop in registrations by one month, as seen in the March – April 2020 time frame. If dealers begin to see a rise in unemployment, they can take steps to mitigate or minimize that dip, through things like incentive packages, special offers, etc. You can also look at indicators such as consumer sentiment, gas prices, interest rates, and more.

That is very useful from a strategic perspective. How should dealerships leverage data when it comes to implementing tactics?

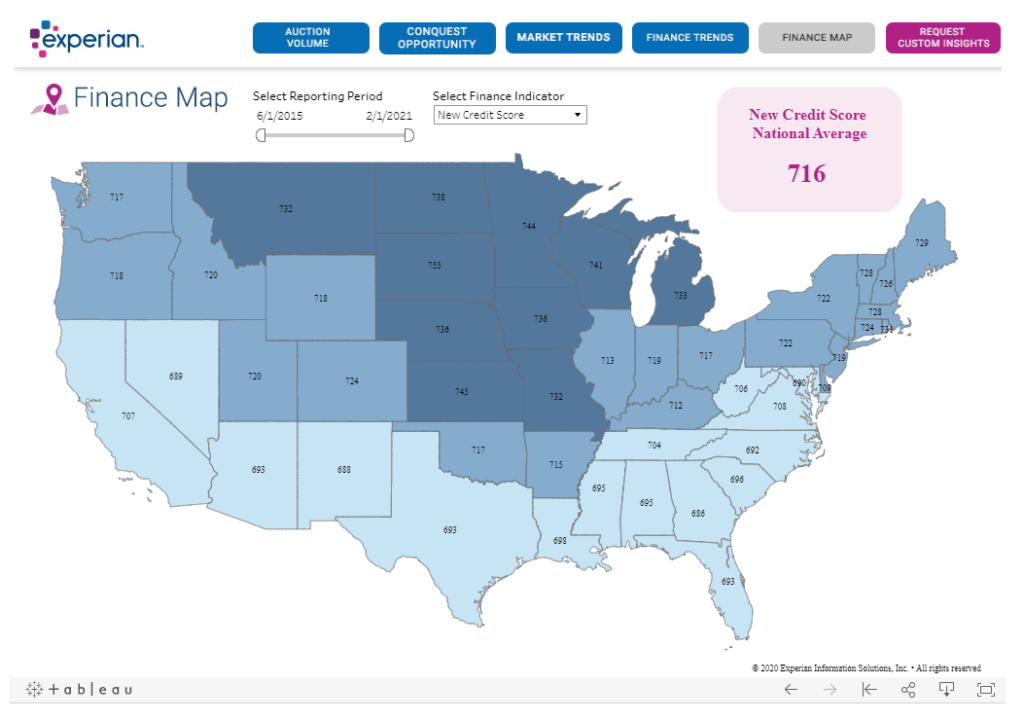

Dealers should start by looking for new opportunities around their store. Usually, this means going beyond the data within a dealership's CRM database, which can open the door to new customer acquisition opportunities. For example, the new Experian Automotive Market Insights dashboard highlights how many consumers are coming into positive equity or coming off lease at the state level, which can help auto dealers and OEMs understand how much opportunity is within their state.

Besides data being a key component to new customer acquisition opportunities, what are other ways that data can help improve marketing efforts?

At the end of the day, it's vital to know who your customer is, and what their priorities are. Layering in additional data points beyond the high-level economic trends can help dealers achieve this. For instance, on a national level, a recent Experian study found that millennials and Gen Z are the only age groups seeing growth in vehicle registrations. Millennials and Gen Z consumers comprised 32.83% of new vehicle registrations in 2020. Equipped with that knowledge, dealers can then take a closer look at what and how these groups like to buy and let that inform marketing strategies. For instance, Gen Z is more likely to finance a vehicle than millennials. Dealers can then tailor messages to each group accordingly, which are more likely to resonate that typical mass-mailings.

While the examples I just gave are at the national level, we always suggest that dealers look at local versions of these metrics, so they can see the nuances in their surrounding area and plan accordingly.

If a dealership is interested in learning more about how to apply data to their own marketing strategies, what do you suggest?

Data is a powerful tool that will continue to drive the auto industry toward recovery, and we want to help dealers as much as we can. In addition to the data readily available on the Experian Automotive Market Insights dashboard, dealers can also request custom insights. These insights will help dealers understand how data can be applied on their local level to better uncover opportunities near their dealership. For more information, visit Experian Automotive Market Insights.

authored by

Dealer Marketing Magazine

Get Curated Insights

Content worth the click

Related Articles