Is Your F&I Compliance "Toast?

What does criminal conduct have to do with F&I and my new toaster? Here you go...

I recently bought a toaster. (Please hold your applause until the end of the article.) The toaster is so generic it does not even have a brand name on the instructions. "Instructions," you ask? For a toaster?

Yes, it came with a full-color, multi-step instruction, which is awesome.

There are "Single bread toasting" instructions in case you might not want to...you know...toast two pieces of bread at the same time. And I quote, "Single bread operation may cause uneven toasting result due to nonuniform heat distribution from the empty slot."

So, I am getting a toaster, a grammatical mistake, and entertainment all for the price of a toaster.

But wait, there's more. It gets better! And here is the tie-in with our business: It shows actual, color photographs of pieces of toast corresponding to the level dial on the toaster, ranging from level 1 (lightly toasted) to level 6 (call the fire department). So, they are asking you to compare the color photos with your toast. I love this! Examine and compare. This is risk mitigation at its absolute finest.

So when was the last time you examined, with a clear head, your F&I practices? When was the last time you (or a trained third party) compared a checklist to a deal folder for compliance? Are your deals "warm and toasty?" Or, do you need to call the Fire Department to hose them down?

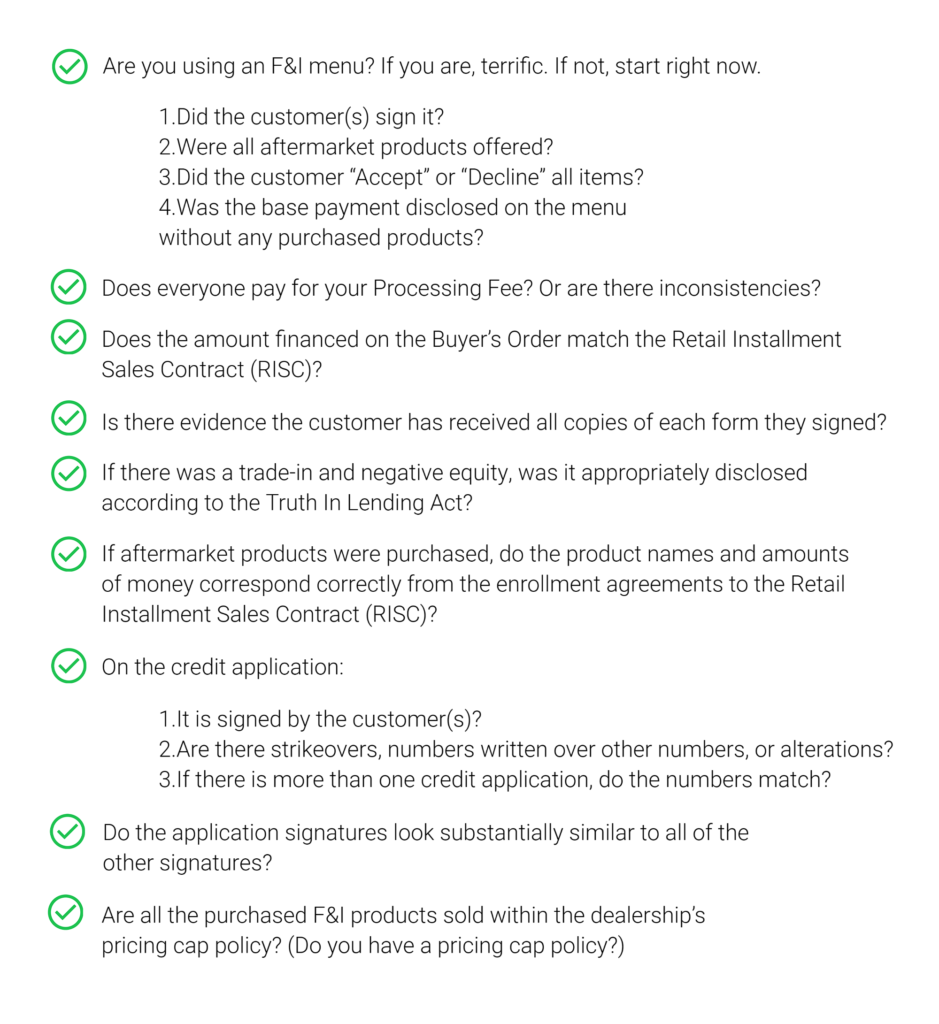

If your dealership strives toward a better culture of compliance, consider this checklist when reviewing your F&I practices:

This is a partial list representing only twenty (20%) percent of the items that you should be checking.

Examining these practices will help prevent so many problems and allegations, including (but not limited to) product stuffing (quoting a payment that includes aftermarket products), discrimination, income manipulation, Suspicious Activity Reports, and fraud. Some of the items above are just the law, and you are required to comply.

Financial institutions are required to file Suspicious Activity Reports if they believe you have submitted false information to them. It is a requirement for them, not an option.

Some of these items may be obvious, but are you actually checking? Or have you hired a third party to check?

If a regulator walked into your dealership, could you demonstrate that you perform periodic audits to check your F&I department?

Did you know that Section 8 2. of the United States Sentencing Commission considers compliance activity when judges determine the length of jail time? You must "(1) exercise due diligence to prevent and detect criminal conduct; and (2) otherwise promote an organizational culture that encourages ethical conduct and a commitment to compliance with the law."

It is worth noting, the Consumer Financial Protection Bureau (CFPB) recently announced they are hiring additional lawyers for compliance enforcement.

Don't wait until smoke is rising and alarms are blaring. Implement a compliance program now, or you will be a level 6 piece of toast.

Tom Kline

DMM Expert

A dealership franchise owner for thirty years, Tom is now the Lead Consultant & Founder of Better Vantage Point, providing Dealer Dispute, Compliance and Risk Mitigation Solutions.

Tom also spearheads Tuck The Octopus which helps dealerships proactively manage governance, risk and compliance which has a direct impact on the customer experience.

View full profile