Post Covid-19: You “Sell” Online, Now What?

Let’s start with a few recent consumer sentiment and behavior data points. Some good news, some bad news for OEMs and Auto Dealers. IBM recently conducted a consumer sentiment survey in the U.S. to assess current and future forecasted feelings and behavior across many topics, including comfort in returning to a work office, healthcare, travel, movies, and more. We also specifically asked a few questions dealing with modes of transportation sentiment.

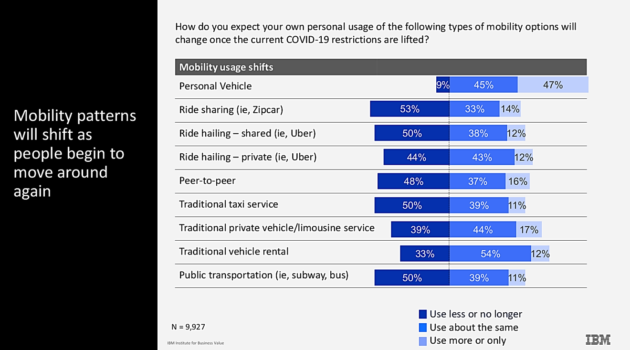

The chart below is the “good news” for OEMs and dealers. The consumer sentiment greatly indicates a more favorable desire for a personal vehicle as the main mode of transportation going forward out of Covid-19 impact. There is also a neutral or positive reaction to private ride-hailing and rental cars. The inference in all of this is that consumers will want to have a “personal car” or ride that many people have not been in and out of right before their experience, or avoids many people sharing the vehicle or transportation at one time.

This does not suggest a difference between new car or used car or how they either currently own or get access to the personal vehicle, but it’s rather just a strong indicator of the desire for personal vehicles as the main mode of mobility in the near-term future.

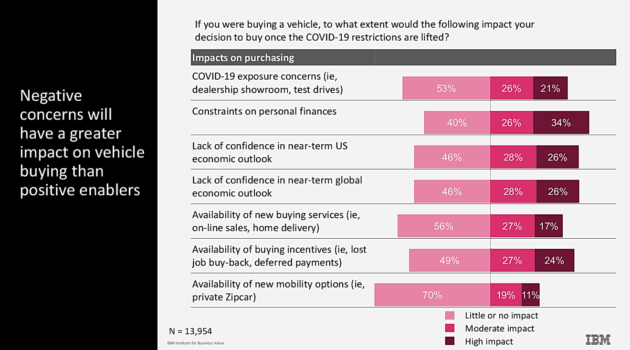

Now the next question would be, does that mean there will be a rush out to acquire new and used vehicles by consumers as dealers begin to open? The short answer is, no, or not necessarily. There are other extraneous factors that obviously affect people’s mindsets about future expenditures, including acquiring a “new car.” The chart below indicates the impact on the consumer’s mindset about buying a vehicle. Obviously, health and safety concerns at the dealership, personal finance, and other buying services and mobility options all weigh in on the decision. In another question, not shown here, these factors also suggest that about one-third of consumers will have a slight delay of about four to nine months in their purchase process cycle due to the pandemic.

So what does this all mean? None of these data points or charts by themselves suggest any one direction or answer. In fact, this pandemic crisis more than ever points to the fact that businesses need to move away from fixed cycle strategies and plans. There must be a more transformative, living strategy, that is always adapting and evolving, and led by consumer needs and expectations, not by the products and services we offer.

Clearly, there has to be more online, on demand auto sales and service capabilities to meet consumers needs and expectations. There has already been a lot of news, maneuvering, push, and acceleration to move some or parts of the online car buying process to the online channel for both OEMs and dealers. Whether that be to get a quote, put down a deposit, or even full cycle “click to driveway delivery,” the components of the sale transaction have now picked up momentum to be more “no touch” or virtual, but is that enough?

The answer is to NOT simply put the current customer sales and service engagement process online and think we have solved for their needs going forward. There must be more evolution, more engagement, more customer mobility journey needs met, in order to build a sustainable model. All the factors of what were already growing consumer expectations anyway, and the current business models disrupted immediately by the pandemic, only put more focus and relevance on the WHAT and HOW we as an auto industry will have to deliver mobility usage and vehicle services.

The What

The data above suggests, and many other studies support that people, especially younger consumers, are more interested in access to mobility than to ownership. Now, more than ever, there needs to be the safety, security, and feeling of “personal” or “personalized” vehicle access.

This sentiment does not say that people want to buy and own a car for four to five years. It indicates they want a “personal vehicle” when they need it. Many factors play into that need. Going forward people may be working from home more, commutes may have shifted, they may not go to crowded places for a while, family transportation needs for school and extracurricular activities may have shifted, vacations and travel may change, they may need various forms of transportation and commuting to meet flexible lifestyle needs.

Not to solve for all the needs in one simple plan, or technology, or business model, but providing for and meeting consumer needs in the near term and ongoing will have to consider newer offerings and services that could include:

- Personalized shopping assistance and vehicle requirement needs support.

- No touch (where personal contact is required) for sales and service vehicle processes.

- Omnichannel and in context consumer journey engagement and support.

- Flexible vehicle access options:

- Fleet / rental availability.

- Flexible contracts (finance or lease) in terms of time, usage and out clauses.

- Consideration for budget, mileage, commute drive transportation, and vehicle access options.

- Various subscription models that provide access to a mobility mode.

- Pick up and delivery and other experience centers outside of the dealership:

- Mobile services.

- Lifestyle and budget-driven configuration, not just product selection.

- Less new car vs. used car:

- Less departmental-centric approach and more customer-centric approach with the OEM and dealership as an entire platform to support.

This is access to mobility. The “what” is mobility. Personal mobility.

The consumer is mobile, not the vehicle.

OEMs and Dealers need to support a consumer’s mobility journey, and be in the mobility ecosystem, not just in the auto sales industry.

The How

So the “what,” or mobility access, and acting as a customer mobility platform can sound overwhelming. But it is a must to view that North Star vision as the adaptive strategy to head towards. It can start with some simpler offerings and build up full capabilities as they become more real and prevalent. But some of the basic tools and engagement models must start now to 1) meet consumers’ expectations and changing sentiment, and 2) gain more information and insight to drive an adaptive, sense-and-respond approach to the future. Every engagement is a chance to learn, and the insight is often much more valuable than the transaction.

Some of the first step considerations to move towards to assist with online and personalized experiences, and more mobility access options include:

- Guided shopping (leverage chatbots, virtual assistants, and A.I. to help people find what they are looking for, not what you are selling).

- Guided process to include more lifestyle, vehicle usage, commute, and budget considerations before selecting or landing on a vehicle.

- More full mobility packages that include flexible financing, mobility service packages, and other accessories or options to meet personal mobility and lifestyle needs

- Start driving business with new metrics to include customer lifetime value, engagement and experience frequency and quality, and share of mileage, not just the traditional transactional kpi’s.

- Look at more customer-centric metrics across the journey and across the dealership; not function by function, or department vs. department. Rather, a holistic view of the consumer.

- Consider every interaction more information and insight to guide the personal touch of that one customer, and as more direction for the future business and offerings needed as a whole from all the customer interactions.

- Data and analytics as a business function, not an afterthought,

- Where possible, look to begin to implement flexible finance, lease, and subscription models for consumer access to personal vehicles or fleet of inventory.

- Not only will this help the consumer, but it may enable the OEMs, captives, wholesalers, and dealers to optimize the assets in terms of more availability and choices of vehicle age, mileage, condition, which can only be turned and optimized again in this very process.

Summary

There is a lot of unknown about the future, what we will sell, how we will sell it, and the consumer expectations going forward. But we do know we need to make the current process more omni-channel and personalized. We also know we need to think about the customer’s mobility journey, and not just as a transaction model.

Most importantly, we need to learn from this pandemic disruption, that our strategy, our business model must be living, and adaptive, because we don’t know exactly what is next, but we do know -- our only chance to sustain is to put the customer-centric model first, and build our capabilities towards that.

authored by

Dennis Ephlin

Dennis is the Head of Automotive Industry, Innovation & Transformation at Capgemini Invent. An innovative strategist and transformer, Dennis’ experience includes driving brand and customer strategy into market and profit realization.

Dennis is a change artist who creates tangible business value through ideation and visioning, creative marketing strategies and process implementations, strategic business transformation and customer understanding and delivery.

Get Curated Insights

Content worth the click

Related Articles