The Future of Auto Retail—A Future Perspective

What will be the business model and value of dealers in the future?

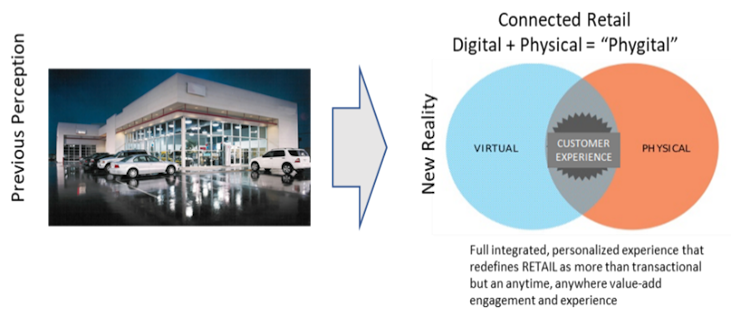

In order to get a perspective on the future of auto retailing, we must first be clear on the definition and elements of retailing today and going forward. “Retail” is not merely the in-store experience or the physical presence of a brick-and-mortar dealership. It is more than just the online shopping activities of a consumer that leads to the dealer visit.

In the future, retailing will mean more than just selling; it will include all interactions and engagements of the consumer through any channel aimed at a valuable exchange of goods, services, or even information and experiences. Retailing will be virtual, physical, multi-channel, and omni-channel. It will support all assets of the brand experience beyond just the product transaction itself.

The following diagram illustrates the new reality of retailing:

Disruptive Forces

It is clear and well accepted that the need and value of an auto dealership must adapt in the future to remain relevant. Not only does it need to remain relevant, but it must be sustainable and profitable. Natural forces of new types of auto sales competition, better vehicle and parts quality, other product/purchase options, and general financial and profit squeeze put pressure on the current dealer business model.

Many disruptive forces are also driving this need for change. Simply trying to squeeze new value and offerings into the traditional dealership model and processes of today will fail. The following topics are some of the major forces driving disruption within the world of automotive retailing.

Shifting Products

We all know and see the beginnings and the future potential of electric vehicles, hybrid vehicles, and even autonomous vehicles. So what? What does it mean for the dealership?

For starters, the value proposition for people buying/leasing/acquiring hybrid or electric vehicles is different. There is a total value of the investment proposition that customers consider in terms of electric charging expense and electric power surplus revenue potential. This very proposition includes more than just the customer and the dealer; it could and should include energy companies as well as the customer’s home or office utility considerations.

This is beyond the traditional dealer salesperson’s current training and mindset in selling a vehicle. We also need to consider that the very service and parts for these vehicles are much different than the traditional mechanical repairs that the industry has been profiting from lately.

When it comes to autonomous vehicles, the proposition is very different. Will this type of mobility change the entire vehicle ownership model? Fleet and city/government/corporate-owned fleets of transportation for personal access will grow. If an individual owns an autonomous vehicle (or any vehicle for that matter), there are car-sharing, P2P, and other services available to offer it to the market for sharing or usage. This, along with repairs, maintenance, and vehicle tracking — and management in this case — is a very different and disruptive model to the traditional dealer of today.

New “Usage” Models

Another influence on paradigm shifts of traditional sales and retailing in the auto industry is the increase in ownership and access models available to consumers. There is no longer a simple binary decision for a consumer that if they need a vehicle, they go to a dealer and either buy or lease that physical asset. Consumers interested in transportation or general mobility needs have many more choices, including subscription models for acquiring part ownership or usage of a vehicle or access to a fleet of vehicles.

Other forms of mobility access such as mass public transportation, car sharing, and car ride services have increased the competitive environment for dealers to just “sell a vehicle.” This puts pressure on the dealership model, whose very essence is to stock inventory for sale on behalf of the OEM to “sell” to consumers. This is a fundamental breakdown in the current dealership model, with consumers’ mobility needs being broken up into many segments in the marketplace.”

Consumer Expectations

How could consumer expectations disrupt automotive dealers? In today’s digitally transformed world, customers are receiving more on-demand, instantaneous, and fully visible experiences and services. For example, just using a mobile smartphone, you can book a car ride to the airport, play your custom song list, plan your flight, and rent a property at a beach resort where your pre-ordered groceries, rented sports equipment and rental car is waiting for you. This could all be done in less than 5 minutes with a few dozen screen swipes on the phone. That is the “On-Demand Economy” in which we now live.

How long does it take at the average auto dealership just to complete the application, finance and contract process? The trip to the dealership and the customer experience that comes with it can be daunting because of the very long and drawn-out process. This does not align with today’s expectations of quick and easy. “The last best experience we have becomes our standard expectation going forward.” That mantra carries across industries, and across life; we expect more because more has been delivered to us in certain segments.

One more trivial example: a person can order a $5 pizza from an app, choosing from a previous order and given an on-the-spot discount offer. The entire order is then tracked from start to finish, all from a smartphone. This engagement and visibility is available for a simple $5 pizza. Yet, more often than not, trying to get an update on a vehicle service repair at a dealership takes several phone calls and returned calls with estimate ranges given — a mismatch in expectation versus experience in the dealership business model.

Future Point-of-View

The future of auto dealerships survival will not be enabled by physical inventory and assets or traditional parts and service. No matter how much these departments are squeezed for cost reduction and profit margins, it will not be enough. The future survival and success of auto dealerships will be enabled by those that can create a customer network platform and deliver new goods, services, and experiences into that ecosystem. The future retailers in the mobility industry will be those that offer and deliver on the following:

New Services

These may include mobile servicing, electric vehicle charging and power utility exchanges, storage, rentals, shopping and concierge services.

Fleet and Fleet Management

Offering and managing a fleet of vehicles for consumers to acquire, borrow, or even serve as the outpost for person-to-person and car sharing platforms (pick-up/drop-off) and servicing needs.

Access Models

Retailers of the future will need to think of “offering mileage and mobility” and not just selling inventory. Enabling all ways for consumers of mobility to buy, lease, borrow, rent, and access mobility and mobility needs will be a major service of the future.

Personal Concierge

Serve and meet the multitude of needs that come with the consumer’s entire mobility journey. This includes vehicle access, usage, flexible servicing, full-service provider or manager of mobility needs that include finding and delivering mobility, vehicle options for use, scheduling, pick-up, delivery, insurance, financing, maintenance, and much more.

Customer Mobility Platform

Successful retailers in the future will operate more as customer mobility platforms — arranging and delivering all of the above possible services. This will help them become an “On Demand” mobility access platform for consumers of all kinds, all needs, and all models.

Measures of Success

One of the motivators and enablers of change is to start measuring and acting on what will become more important key performance indicators in the future. The traditional measurements of sales, market share, and monthly transactions will not be enough to drive a future retail model towards more customer connection and customer experience.

These will be measurements of value, change, and of a more sustainable business model. These measurements will indicate the strength of the customer network and the business model to adapt and expand into other needs and values that customers will require in mobility and mobility services.

So, What Do We Do?

The answers to near-term success are not at our fingertips today. Shifting the model to a customer mobility network or platform will take one step or capability at a time. Think of the enterprise as an adaptive network of customers with mobility needs that future retailers must look to serve in a more holistic and experiential way. That adaption requires better customer connections, better data, better insight, and the ability to innovate.

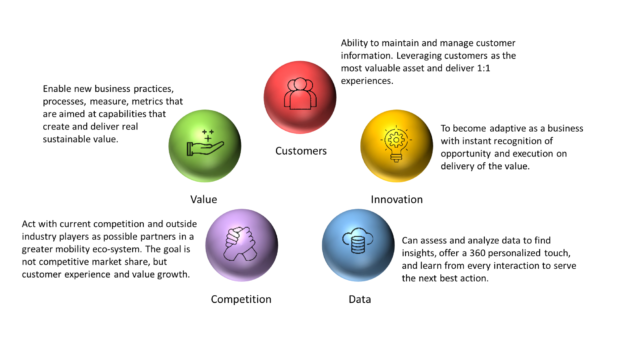

Change will come through five major areas or domains:

Ask yourself what is being done in these five areas to be more adaptive, more insightful and more valuable to customers. Establish plans and a roadmap to begin to grow the capabilities in these areas that identify and deliver new services aimed at the future customer mobility journey. Take a look at other industries outside the traditional auto retail industry in terms of mobility access and value creation. Shift the customers, shift their mobility needs and shift the delivery of experience into their journey as the primal factor for success in the future, because it will be.

It may not be easy, but it is necessary!

Tags:

authored by

Dennis Ephlin

Dennis is the Head of Automotive Industry, Innovation & Transformation at Capgemini Invent. An innovative strategist and transformer, Dennis’ experience includes driving brand and customer strategy into market and profit realization.

Dennis is a change artist who creates tangible business value through ideation and visioning, creative marketing strategies and process implementations, strategic business transformation and customer understanding and delivery.

Get Curated Insights

Content worth the click

Related Articles